Now, if you’re paranoid like I am, you can keep a checkbook register of your own with you as an added dose of protection, but it’s not really necessary to do so.īy the end of the month, you should do a comparison of the ending balance on your checkbook register or budgeting app and the balance shown on your online banking app. You might make mistakes at times, but, if you’re diligent or using a budgeting app for your personal finance, it should be much easier since you won’t have to keep track of your new balance by yourself.Īll you have to do is just input the amount added or subtracted and it will take care of the rest. This is the main goal in keeping a balanced checkbook. I’d personally suggest doing it daily, but weekly is fine too (just make sure it’s not any less frequent than that). You can either do it whenever such a transaction occurs or at the end of the week if you keep your bank statements and receipts handy.ĭo make sure to write the date as well as the amount in so you can find them easily if someone requires confirmation of a payment or a different issue arises. This means tracking any ATM withdrawals, direct deposits, any credit card and debit card purchases, bill payments, service charges, issued checks, bank fees, and the like.īasically anything that will interfere with your register balance. Track all unclaimed checks and transactions that are still pending in there as well – you don’t want them messing your math up before you even start, just because you overlooked them.Īlso, always make sure to jot down what each of these transactions paid for to make a more streamlined system that makes it easier to find the right transaction at any given time in case of an emergency.

#Balanced my checkbook how to#

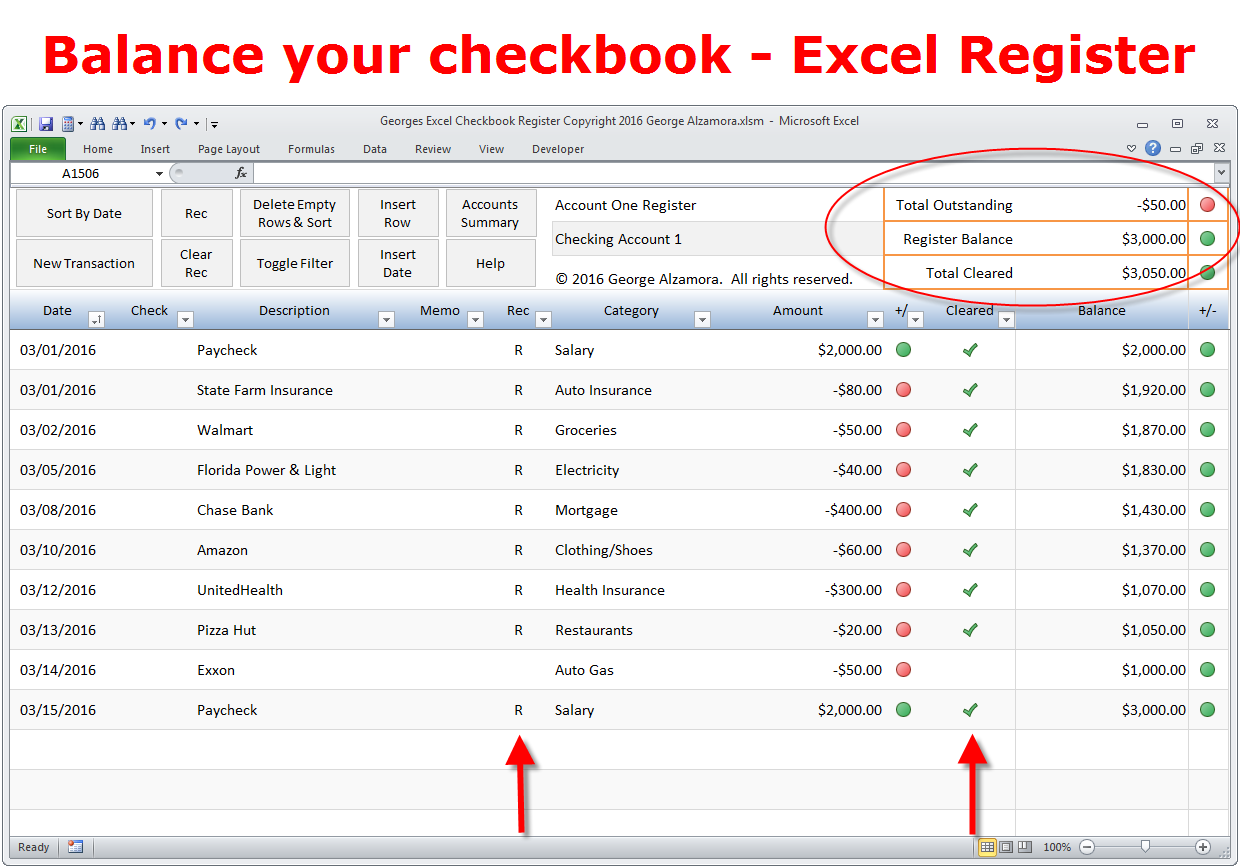

That’s your starting total, your current balance, and the start to your journey on how to balance a checkbook.Īfter this starting account balance is confirmed, you can begin actively jotting down any withdrawals or deposits that you make. When looking at how to begin balancing your checkbook, you’ll want to go to the bank to issue the most recent bank statement of your available funds on your checking account. We have technology for that! And there are a number of apps that will help you keep your checking account in order and add or subtract all of the statements that you enter in your virtual checkbook register. That, and having a really good system in place, since – let’s face it – we’re in the 21st century, we don’t have to do everything by hand. It’s mostly just a matter of dedication and meticulousness, much like how anything related to budgeting usually is. Keeping a clean and precise checkbook isn’t something overly difficult, it’s just basic math, albeit with somewhat higher numbers than third grade of primary school. * The "Sync for 4 Users" purchase is a auto-renewing monthly subscription.The question on how to balance a checkbook ends up on everyone’s mind at one point or another, whether it’s on a daily, monthly, or even annual basis. Filter transactions by cleared or uncleared status Schedule recurring transactions (weekly, biweekly, and monthly) Sync data with other users and devices *Coming soon* Never forget your checkbook register or have to do math again! Balance My Checkbook replaces your paper checkbook register with a simple and easy to use interface on your phone. Now it's easier than ever to track your checks and balance your checkbook. Please buy "Balance My Checkbook" instead.

0 kommentar(er)

0 kommentar(er)